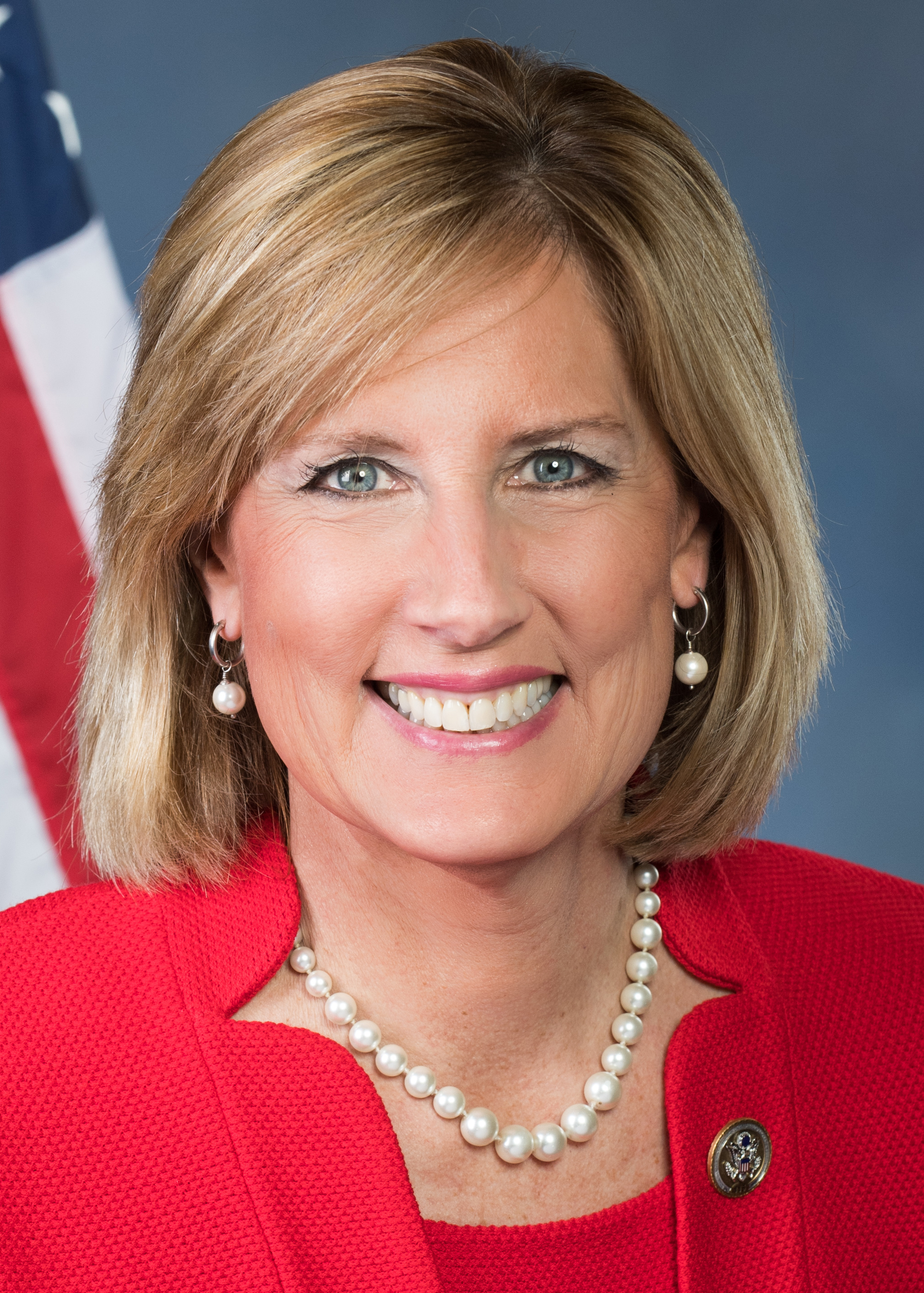

Congresswoman Claudia Tenney (NY-22) joined President Donald J. Trump and U.S. Treasury Secretary Steve Mnuchin at the Department of the Treasury as the President signed an Executive Order and two memorandums.

The Executive Order directs the Treasury to examine taxes and regulations implemented over the last year and a half, and will require the Treasury to report if the previous administration’s taxes and regulations are necessary, or undue and present a burden to taxpayers and American businesses.

While the memorandums direct the Treasury to review two major harmful Dodd-Frank provisions, the Orderly Liquidation Authority and the Financial Stability and Oversight Council. The memorandums also require the Treasury to provide a written report with the findings to the President within 180 days.

“It is an honor to stand with President Trump and Secretary Mnuchin today as we begin the process of reforming our complex tax code and streamlining the financial regulatory process,” said Rep. Claudia Tenney. “This Executive Order allows experts at the Treasury Department to weigh the necessity of taxes and regulations and suggest ways to eliminate the taxes if deemed harmful to the growth of American businesses and the taxpayers.

“Eliminating onerous, unnecessary taxes and regulations will unleash our job creators and give American businesses and entrepreneurs the tools they need to be successful and competitive, bringing trillions of dollars back into our economy. As a former small business owner, I experienced firsthand how taxes and regulations cripple our American small businesses, put our companies at a competitive disadvantage and hurt economic growth in our communities. Finally, we have a President who is committed to prioritizing Americans businesses and putting our hardworking taxpayers first.”

The two memorandums will focus on reforming our financial regulatory processes. Originally designated in Title II of Dodd-Frank, Orderly Liquidation Authority gives government officials the ability to resolve large financial intuitions outside of the standard bankruptcy procedures by borrowing funds from the Treasury Department, essentially a taxpayer bailout. This memorandum suspends the use of the Orderly Liquidation Authority, while the Treasury reviews this process.

Additionally, the Treasury Department will review the Financial Stability Oversight Council’s (FSOC) ability to determine which non-bank institutions are designated as “systemically important.” The designation process is currently based on ambiguous standards, creating one of Dodd-Franks broadest areas of regulatory overreach, further entrenching “too big to fail.”

Rep. Claudia Tenney continued, “Dodd-Frank did little to end bailouts; in fact, Dodd- Frank codified ‘too big to fail,’ made big banks bigger and put taxpayers on the hook for funding big bank bailouts. Through FSOC, Washington bureaucrats are given then ability to deem institutions, both financial and non-financial, ‘too big to fail.’ In other words, FSOC’s inconsistent designations decides who is placed at the front of the line for a taxpayer funded bail-out.”

“Dodd-Frank also created a new bailout fund called the Orderly Liquidation Authority, which gives bureaucrats the ability to operate behind closed doors to determine, when institutions are failing, which of the institution’s creditors the government will protect and which they will leave behind. Through OLA, ‘too big to fail’ institutions can practice risky behavior knowing full well that there is a federal backstop to insulate them from loss. This taxpayer-funded safety net is irresponsible and promotes reckless behavior, increasing the likelihood of future bailouts. Ending these practices will hold both Wall Street and Washington accountable and put us on the path to building a healthy economy,” concluded Rep. Claudia Tenney.

As a member of the Financial Services Committee, Rep. Tenney has reviewed these provisions extensively and participated in a number of hearings examining the harmful provisions of Dodd-Frank. At a recent hearing, Rep. Tenney spoke about the need to reform FSOC and the harm it causes to our economy and non-bank institutions.