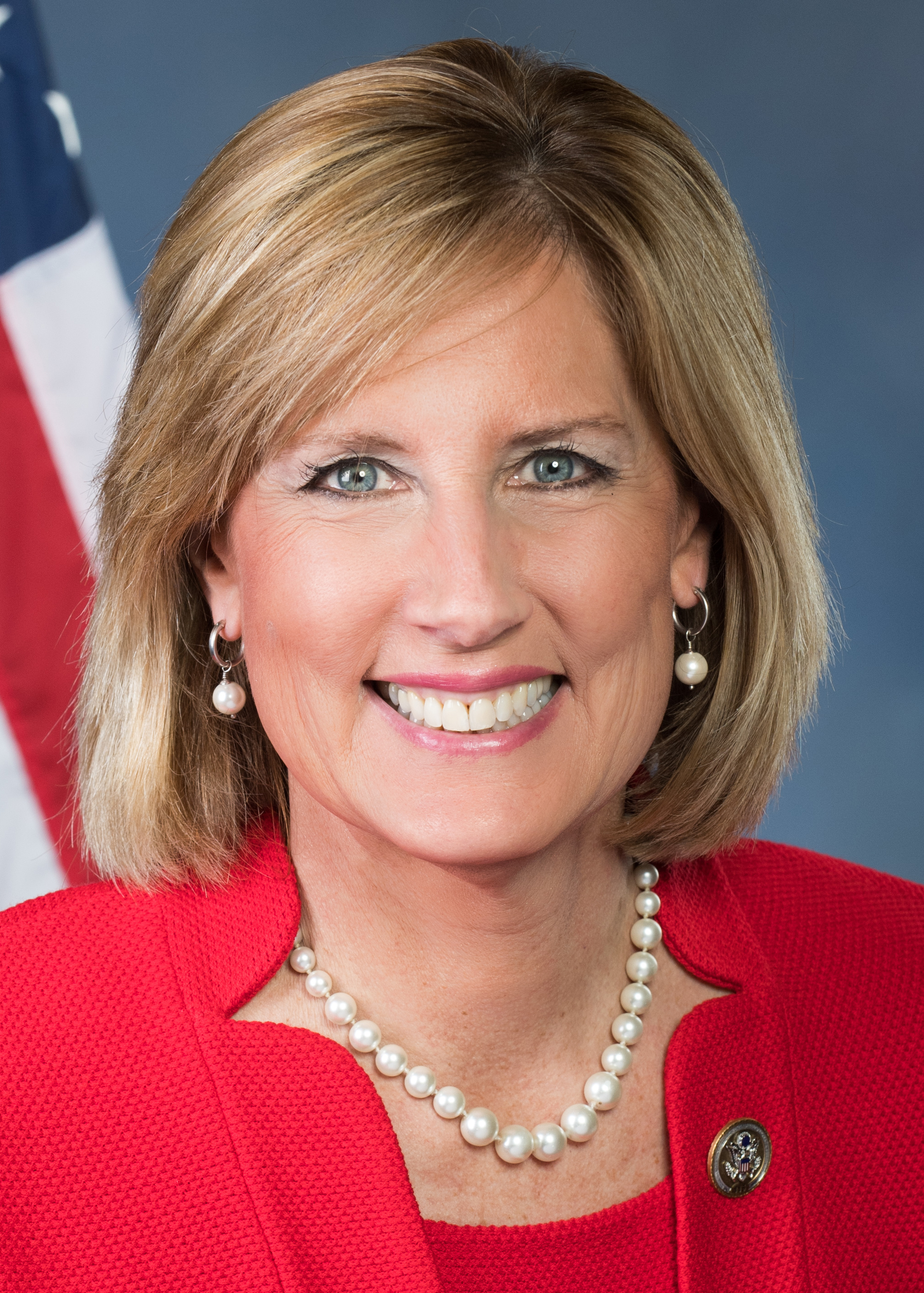

Today, Congresswoman Claudia Tenney (NY-22) released the following statement in response to the Financial Services Committee’s hearing examining the Equifax data breach:

“Security breaches have become all too common and increasingly sophisticated. The Equifax data breach affected nearly 145 million consumers in the United States, nearly half of all Americans. When Equifax learned of suspicious activity, they failed to disclose the breach for six weeks. Since then, consumers have struggled to determine if they were actually a victim of the breach as the information provided to them by Equifax has been confusing, unclear, and at times completely incorrect. This hearing was the beginning of a comprehensive process to improve consumer protections and increase overall privacy standards. My office stands ready to assist any constituents impacted by this breach. If you believe your information is compromised, please do not hesitate to contact my office. All individuals should consider placing a credit freeze on their files to make it harder for someone to open a new account in their name. It is also important to continue monitoring existing bank accounts and credit cards to ensure suspicious actives are not taking place.

What we learned from the hearing:

- With nearly half of all Americans impacted, this is the most harmful breach of private consumer information in our history.

- Names, Social Security numbers, birth dates, addresses and driver’s license numbers of over 200,000 consumers were accessed during the data breach and the company took six weeks to disclose this vital information. All the while, consumers were completely left in the dark about the fact that their personal information had been compromised.

- Equifax failed to patch known security issues in their systems, which increased their vulnerabilities to hacking.

What we are doing next:

- The hearing is the first of many steps the Financial Services Committee will take to ensure American consumers are protected from security breaches like this in the future.

- Congress will continue working in a bipartisan manner to investigate these incidences and, where necessary, take appropriate legislative action to improve consumer protections and reporting requirements.

- In particular, implementing a national standard for data breach notifications would create a uniform requirement nationwide so that consumers are notified if their financial data is acquired without their authorization. Had this been law during the Equifax breach, Equifax would have been required to notify consumers immediately instead of waiting six weeks.”