Congressman John Faso (R-Kinderhook) has introduced H.R. 1871, the Property Tax Reduction Act, which will eliminate New York State’s ability to mandate Medicaid costs on local county property taxpayers.

“For 51 years Albany has been unfairly mandating counties to pay for a significant share of state Medicaid costs,” said Congressman John Faso. “This mandate has caused property taxes to skyrocket and in turn crushing homeowners, seniors, and businesses. Exorbitant property taxes and lack of jobs are the main reasons why New York State continues to lose population to other states. Simply put, New Yorkers continue to vote with their feet, fleeing the Empire State. My legislation is a smart solution that rectifies a mistake made more than five decades ago and restores local control over spending decisions on infrastructure, public safety, recreation, and economic development.”

New York State has one of the most expensive Medicaid programs in the country. State leaders have continually added to Medicaid spending, in part, because Albany imposed part of its costs on local government taxpayers. This property tax burden reduces real estate values and represents an unfair burden on homeowners and commercial property taxpayers. New York stands in stark contrast to what is done in virtually every other state. The Property Tax Reduction Act would eliminate approximately $2.3 billion in county property taxpayer costs on a statewide basis starting in 2020. New York City is excluded from the bill as it relies upon a local income tax to support its $5 billion Medicaid share.

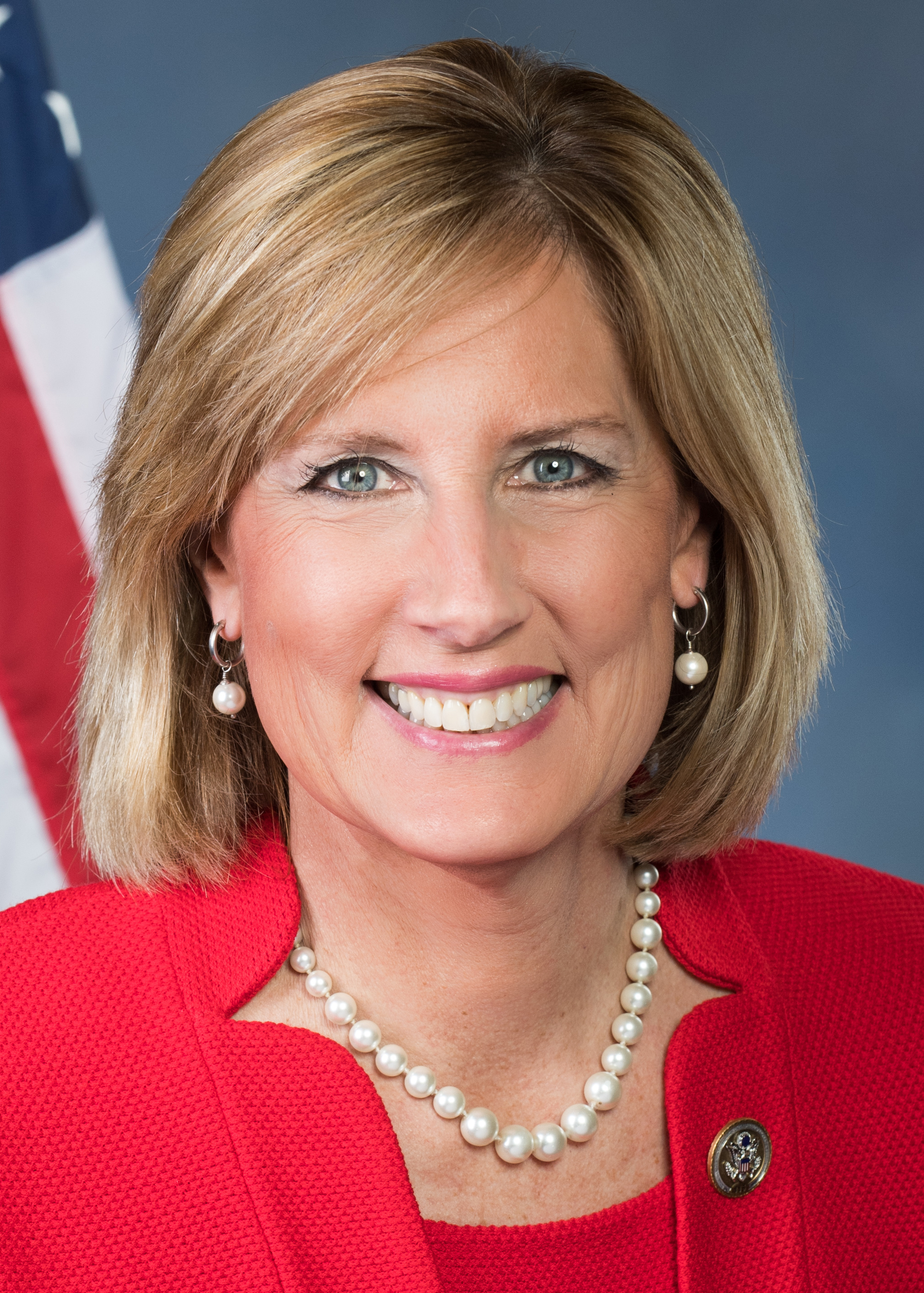

Original co-sponsors of the Property Tax Reduction Act are Representatives Chris Collins (NY-27), Elise Stefanik (NY-21), Tom Reed (NY-23), Claudia Tenney (NY-22), and Lee Zeldin (NY-1).

“The healthcare process provided the opportunity for reforms vital to Western New York, specifically my amendment to force Albany to end its unfunded mandate on New York’s counties once and for all,” said Congressman Chris Collins. “I want to thank Congressman John Faso for his leadership in continuing this fight and introducing legislation which will address the issues the amendment raised. I will continue to work to ensure this legislation becomes law and provides the type of tax relief New Yorkers desperately need.”

“I am pleased to join my colleagues on this important legislation to end the Medicaid mandate that crushes counties in our district and hurts taxpayers,” said Congresswoman Elise Stefanik. “New York State currently raises over $7 billion from its local governments to fund its $27 billion Medicaid liability, which is the largest amount in the nation. This crushing burden presents serious problems for county governments and is an issue I have heard about frequently from our local officials. By making New York State responsible for their own budgeting, we can provide needed relief at the county level and help reduce property taxes for hardworking families and businesses in our district. I thank John Faso for his dedicated work on this issue and I will continue to work in Congress to serve the needs of my district.”

“We are going to solve the problem of bad state policy currently hurting our vulnerable senior homeowners,” said Congressman Tom Reed. “This bill will also bring relief to working families who for too long have been negatively impacted by unfair mandates imposed by Albany.”

“In the 22nd District, property taxpayers foot the bill for nearly $200 million of the state’s Medicaid budget. For decades, Albany has forced these costs, in the form of unfunded mandates, onto our already struggling local governments. It’s far past time that Albany work to cut wasteful, out-of-control spending and finally manage its Medicaid program the way that every other state in the nation does,” said Congresswoman Claudia Tenney. “I am honored to join my colleagues in the New York delegation in cosponsoring this legislation that will shift the local share of the Medicaid burden back to the state and align New York with the rest of the country. This will relieve the overburdened local property taxpayers in Upstate New York, who pay among the highest taxes in the nation.”

“I am proud to cosponsor the Property Tax Reduction Act, which is the single greatest act of mandate relief ever provided to the County of Suffolk, and most importantly Suffolk taxpayers. New York State absolutely can and should identify and achieve the $2.3 billion amount of efficiency necessary and available in the state Medicaid system and make it clear that this can be achieved without harming any low-income New Yorkers in need of coverage. This legislation single-handedly flips Suffolk County’s recurring, massive nine-figure budget deficits into budget surpluses. Taxpayers in Suffolk County are hitting the jackpot of mandate relief as a result of this proposal,” said Congressman Lee Zeldin.

Read more about the Property Tax Reduction Act:

- Fact Sheet: Property Tax Reduction Act

- H.R.1871: Bill Text

- What Property Tax Reduction Act Supporters are Saying