House passes legislation ‘giving community financial institutions much-needed relief’

Tenney’s bipartisan Dodd-Frank reform bills were passed with regulatory relief legislation, and both are headed to the president’s desk

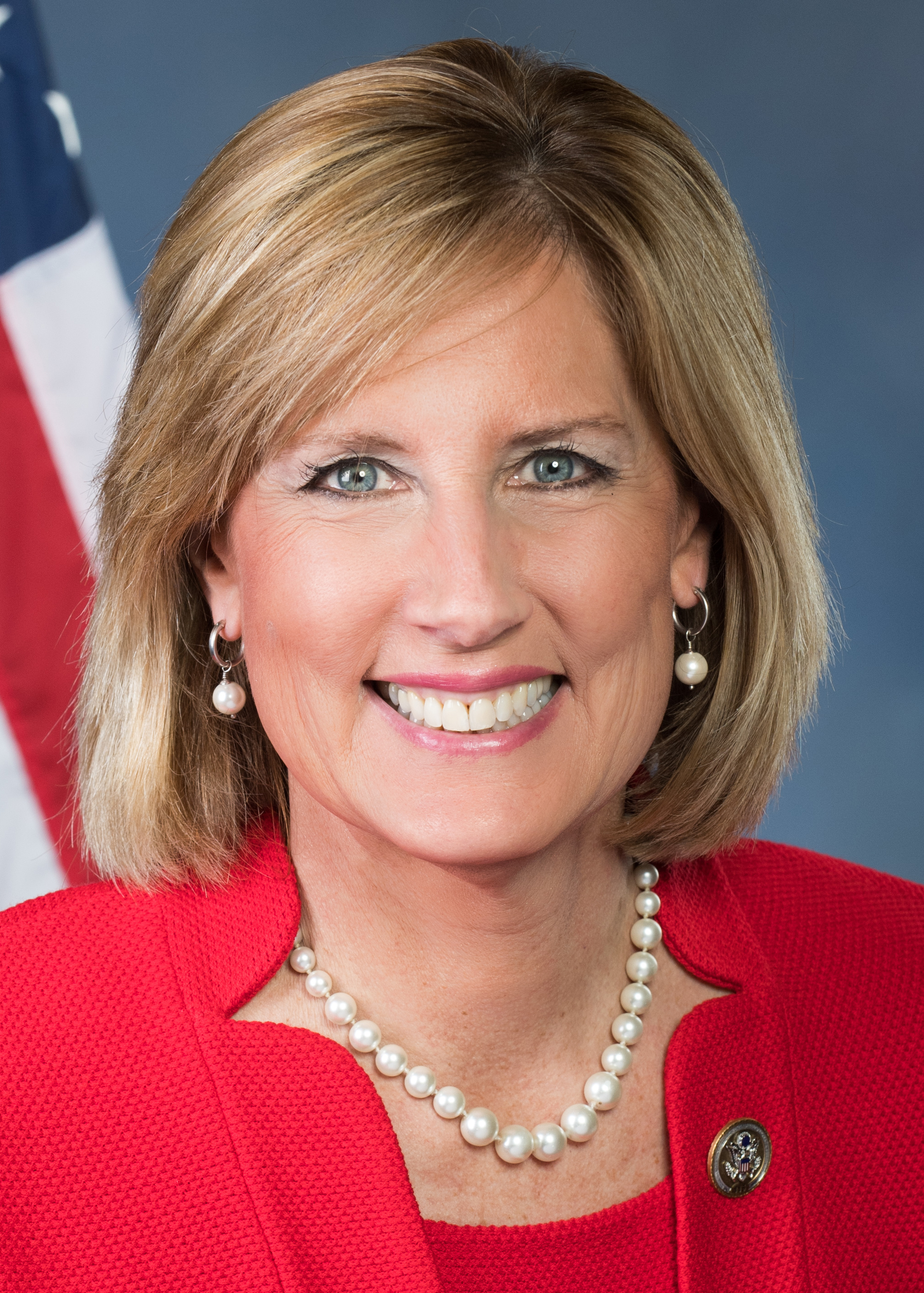

Congresswoman Claudia Tenney (NY-22), a member of the House Financial Services Committee, announced yesterday the passage of S. 2155, the Economic Growth, Regulatory Relief, and Consumer Protection Act-a bill to reform the Dodd-Frank Act’s impact on community banks and small institutions.

Additionally, two pieces of legislation Tenney introduced to ease burdens on community financial institutions were included in the Dodd-Frank reform package—the Small Bank Exam Cycle Improvement Act and the Community Institution Mortgage Relief Act. Tenney said her bills tailor regulatory standards for small community banks and credit unions, which were disproportionately hurt by the one-size-fits-all regulations of Dodd-Frank.

“Dodd-Frank has failed to accomplish what its authors intended,” Tenney said. “Instead, Dodd-Frank’s one-size fits all regulatory structure has put a target on the backs of community financial institutions, driving community banks to near extinction and making ‘big banks’ even bigger. Since its inception, hardworking taxpayers have seen their paychecks stagnate, mortgage loans have grown increasingly expensive and small business owners are unable to access the capital they need to grow their businesses and create jobs.

“The Economic Growth, Regulatory Relief, and Consumer Protection Act will finally realign regulatory standards by rolling back excessive regulations that have stifled community banks and credit unions.

“Community financial institutions are the lifeblood of rural economies throughout our nation, and provide nearly half of the banking industry’s small-business loans despite making up less than 20 percent of its assets.

“Our bill will allow community banks to free up resources to support community growth and serve small businesses, family farmers and entrepreneurs. I am proud to have worked alongside my colleagues from both sides of the aisle on the Financial Services Committee to pass this important legislation to provide desperately needed relief.

“I am also grateful two bipartisan bills I’ve introduced, the Small Bank Exam Cycle Improvement Act and the Community Institution Mortgage Relief Act, are included in the package. Both pieces of legislation ensure small banks in the 22nd District can compete on a level playing field by releasing onerous Washington regulations.

“The Small Bank Exam Cycle Improvement Act fixes a regulatory oversight to ensure small institutions like Tioga National bank, the Bank of Utica, Adirondack bank and many others can keep their doors open. The community Mortgage Relief Act will roll back escrow regulations on small community financial institutions while providing relief from new regulations that have nearly doubled the cost of servicing loans.”

Watch Tenney’s Interview on Fox Business about S.2155 here.