CRUMBS Act will make Bonuses up to $2,500 Tax-Free in 2018

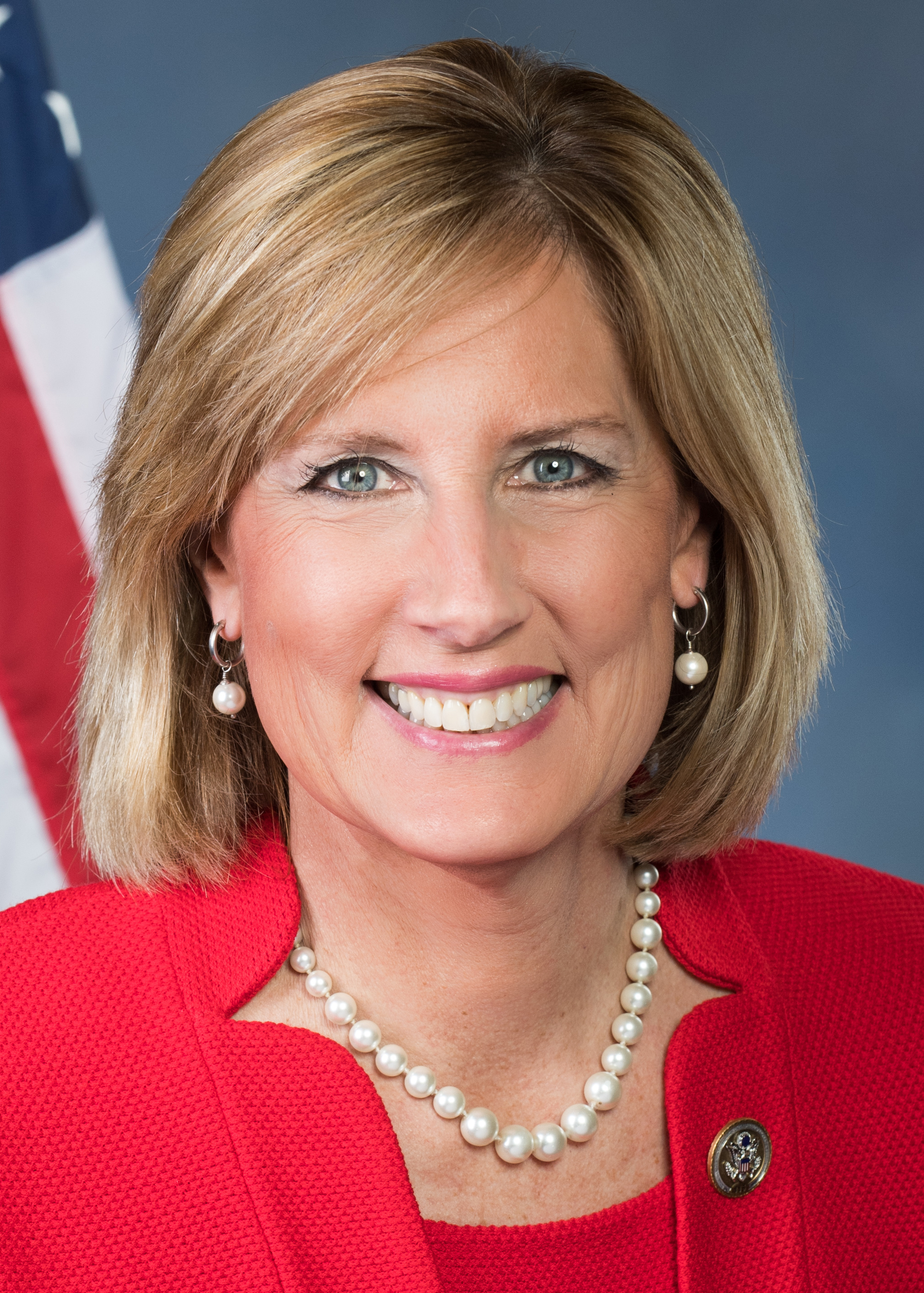

Congresswoman Claudia Tenney (NY-22) cosponsored Creating Real and Useful Middle-Class Benefits and Savings Act. This bill will make bonuses received in 2018 tax-free up to $2,500.

“Thanks to tax reform, Americans have already received thousands of dollars more in their take-home pay, and over 300 companies have given bonuses to their employees,” Tenney said. “This amounts to real money back in the pockets of middle-income families, who know how to spend their money better than the federal government. For most Americans, $1,000 means opportunity. Opportunity to plan for retirement, provide for their children’s education, pay off debt or take their family on vacation. The CRUMBS Act will allow Americans to keep more of their hard-earned money, and give them the freedom to choose how best to spend their bonuses.”

President Trump’s tax reform legislation has led to over 4 million Americans receiving bonuses, pay raises and increased benefits.

In the 22nd District, local companies are giving back to their employees and communities. NBT Bank is raising the starting hourly pay rate of $11 to $15 per hour. Suit-Kote employees will receive an automatic 2-percent increase in their take-home pay in 2018 and an 11.5 percent increase in their 401k plan.